After a slow economy the past decade, things are starting to pick up once again. Many consumers are looking for ways to make money and wondering where they can invest and make a profit. Index funds are getting a lot of speculation; here’s all you need to know about what they are and if they’re right for you.

What are Index Funds & How Do They Work?

Index funds are groups of stocks picked to demonstrate certain portions of the stock market. Examples of indexes are the Nasdaq 100, the Dow, and the S&P 500, among others. Most index fund investments are based on the stocks of 500 top companies in the leading industries.

Index funds are market funds that track market indexes of the top stocks and mirror their performances. When you make an investment in one of these companies, you’re actually becoming a part owner. When the company makes money, the value of the stocks increases and you make money. Some pay dividends each time the stocks increase in value.

Why Index Funds Remain the Best Investment Choice?

For starters, index funds are the most popular investments for 401k and other retirement plans. This is because they’re based on the performances of the top stocks in the market, which eliminates a lot of the sloppiness and risk often found in the stock market. Index funds are popular because they follow an index, eliminating the need for a manager or third party. They come with fewer fees than regular stocks and have lower capital gain taxes, which bodes well for income taxes.

Do I Need Specific Knowledge to Invest in Index Funds?

Unless you’re working with a knowledgeable stock broker, you absolutely should have some knowledge of how to invest and of what index funds you think might be profitable. Although index funds are known to be the most cost-effective funds you can invest in, you still need some experience or basic knowledge of how they work.

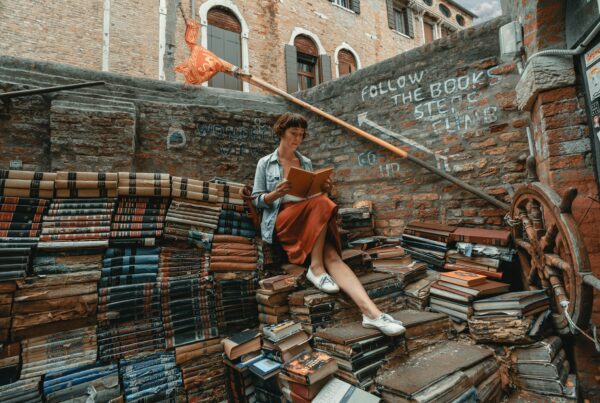

Without this knowledge, you may as well throw your money out the window. Whether it’s online or through a book at your local library, do some research on investing and index funds before you even consider investing. If you know someone who successfully invests regularly in index funds, you may find it beneficial to solicit their feedback and advice.

Should I Invest in Index Funds?

The decision to invest in index funds should depend on your financial situation. The idea of making money is great, but it doesn’t always work that way. If there’s one thing the stock market is famous for, it’s the tendency to be unpredictable. Before investing, you need to be in a financial situation where losing money on index funds won’t set you back permanently. You don’t want to set yourself up for failure by investing more than you can afford to lose. Remember that it’s a good idea to enter the stock market knowing you may lose.